This article originally appeared in FS Super and The Journal of Superannuation Management.

Digital advice is set to play a vital role for superannuation funds wanting to engage their growing memberships and steer them toward better retirement outcomes, says Midwinter’s Steve Davison.

The era of the mega super fund has just begun, and it is quickly re-shaping the value proposition superannuation funds offer their members, including their investment in capability to provide financial help, guidance and advice to more members.

There are now at least seven super funds that each serve more than 1 million members, and more are likely to be created by mergers over the next 1-2 years. Australian Prudential Regulation Authority deputy chairperson Helen Rowell recently said funds with less than $30 billion in assets will be uncompetitive and should consider merging.

While that level of minimum assets is debatable, there is no question that large funds will increasingly dominate the industry. Effectively engaging and supporting hundreds of thousands, if not millions of members and representing their best financial interest, is an opportunity for business growth, and more importantly, an opportunity to set more Australians up for a better retirement.

The future of retirement will likely depend on how these mega-funds communicate, engage and help their growing memberships through digital and hybrid channels.

Member engagement: the new frontier

The problem of low member engagement is not new. The Productivity Commission dedicated 48 pages of its 2018 industry report on this issue alone.

The compulsory, or non-discretionary nature of the superannuation guarantee, combined with a preservation age often decades in the future does little to help people make decisions today that could improve their outcomes later in life.

The retirement system is also inherently complex, and low levels of financial literacy do not help. This, combined with the perception that professional help – advice – is too expensive for many people, means members will often turn to avenues such as friends and family for help.

The result is little engagement, which can have material consequences on retirement outcomes.

Superannuation providers also have a good reason to boost member engagement; to attract and retain members.

The ‘Your Future, Your Super’ bill passed on 17 June includes several major reforms to the superannuation industry. The introduction of ‘stapling’ and fund performance reporting are additional incentives for change.

The Retirement Income Review signals the potential for further change. The interaction of the three pillars of the retirement system – superannuation, the pension and assets (including the family home) – would see financial advice shift beyond the scope of the intra-fund advice relied on by many super funds today.

For funds to prosper, they need engaged members. Better engagement will also help members make better decisions that lead them to a more comfortable retirement.

Digital is the new normal in a post-COVID world

Digital services have been playing an increasingly larger role in how organisations do business – now COVID-19 has turbocharged the pace of transformation.

A McKinsey global survey of executives late last year found companies have accelerated the digitisation of their customer and supply-chain interactions, as well as their internal operations, by three to four years. Meanwhile, the share of digital or digital-enabled products in their portfolios accelerated by seven years.

“What’s more, respondents expect most of these changes to be long lasting and are already making the kinds of investments that all but ensure they will stick,” the McKinsey report said.

The rising investment in digital is meeting growing demand from customers. Young digital natives (aged 18 to 34) have grown up online and expect their service providers to offer convenient digital ways to interact.

Around 92% of young Australians go online to do their banking and other common activities such as shopping or reading, according to research by ACMA.

Digital use by older Australians is now catching up, with 77% of older Australians using online banking in the six months to June 2020, compared to just 59% three years earlier, according to the same ACMA research. An estimated 15% of those aged 65 and above started using online legal, financial or other professional consultations for the first time.

However, many older Australians may be less than satisfied with their digital experiences.

“The majority continue to feel overwhelmed by change in the digital environment, suggesting that increases in the use of technology among this group are potentially the result of the changing, more digitised environment that emerged during the COVID-19 period,” the ACMA research found. “In a sense, older people are engaging with technology out of necessity, rather than choice.”

It underlines the need for intuitive digital experiences that deliver results.

Technology set to drive super fund engagement

Even with the assumption super funds deliver strong investment returns for their members, few people are comfortable with the prospect of retirement. Too many retirees draw down the minimum amount possible from an allocated pension because they fear running out of savings. In reality, many can afford a better retirement lifestyle, according to the government’s Retirement Income Review.

“People need better information, guidance and good, affordable advice tailored to their needs,” the review found.

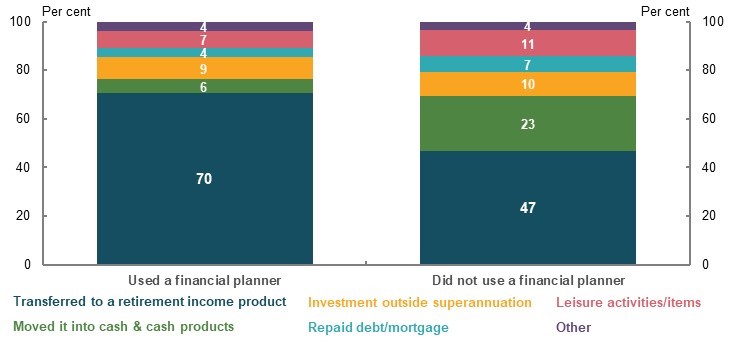

The review quoted research showing that people who do not use a financial adviser at retirement transfer too much of their wealth into cash and similar low-returning assets. This is likely to produce lower retirement incomes, as shown in the graph below.

How retirees use their savings: with or without advice

Super funds have an opportunity to offer accessible and affordable advice to plug this gap.

Currently, many super fund members do not seek face-to-face financial advice. With adviser numbers forecast to fall and scant evidence of productivity gains, the cost of face-to-face advice is unlikely to fall.

The answer for growing super funds is to provide more financial help through digital advice.

While there is still much conjecture around the ability to provide digital advice, the technology exists today. Some funds are taking this a step further by integrating advice with their registry and other digital platforms. Midwinter underpins digital advice delivery for several major funds and is now integrating its technology with Bravura Solutions’ Sonata Alta platform to help super funds accelerate their digital transformation initiatives. Digital advice is a key part of that journey.

The integration of Digital, Advice and Administration platforms enables member journeys to be executed automatically across the front, middle and back office – reducing time, cost and the risk of human error.

This creates a far more compelling proposition for members. It allows advice to be implemented quickly and accurately and sets the foundation for straight-through-processing.

For example, the research above shows that an unadvised member retiring is likely to allocate too much of their assets to cash. A fund can target these ‘at risk’ members directly as part of a digital advice campaign because the technology is fully integrated into its systems.

The member can then go to the fund’s website or app, establish their objectives, provide their personal details, and receive personal digital advice about how they should invest their retirement savings. This advice automatically generates a compliant Statement of Advice.

Integrated digital advice is also highly customisable by super funds and can start small with intra-funds advice. However, digital journeys should also allow for automated escalations to human advisers based on certain triggers or member needs, and a fund can use the digital advice platform to move between self-directed advice to human supported advice (whether it be face-to-face, phone or video) depending on need, circumstance or preference.

The recent example of the early super release scheme during the peak of COVID-19 provides a good use case for digital advice. There are plenty of informed views on the scheme and the likely impact for an individual assuming average aggregate or cohort data. However, this is not a substitute for accessible real-time advice at the point of access. Digital advice would enable a member to quickly model the longer-term consequences of withdrawal against an alternative such as paying down a mortgage.

This new era of technology will transform members’ relationships with, and perception of their super funds, and many of their advice interactions will become as seamless and self-directed as the relationship they have today with internet banking.

Funds now have ability to licence digital advice technologies to offer their members services that rival the best digital experiences available – not just by rival super funds, but across industries. The reward will be more financially literate, engaged members with better retirement prospects that truly value their super funds as custodians of their retirement savings.

Steve Davison is the Chief Commercial Officer at Midwinter Financial Services. You can fund out more about Midwinter’s Digital Advice solutions here or by emailing [email protected].